The Radar: Tracking Military Family Financial Fitness

We’ve surfaced salient points from a range of sources to understand how military families are really faring on the financial front. Keep reading the summary or jump to our library of Research.

A Note from David Evetts

At The USAA Educational Foundation, we regularly analyze the latest findings about military family financial habits to inform the ways we support their financial literacy and success.

Now, for the first time, we’re sharing our analysis and insights. I’m proud to introduce The Radar: Tracking Military Family Financial Fitness.

This summary elevates key findings about the state of military financial fitness and distills them into tangible takeaways. By sharing it, we hope to support more informed decisions among the many stakeholders invested in helping our service members and their families thrive.

All the best!

David Evetts

Assistant Vice President

The USAA Educational Foundation

Analysis From the USAA Educational Foundation Experts

The Government Accounting Officer (GAO) reported several points of financial concern for military families including compensation and benefits, spending patterns, personal financial management skills, frequent or unpredictable deployment cycles, and access to digital or postal communications while deployed. All of these concerns can potentially lead to delays in meeting financial commitments.

The Government Accounting Officer (GAO) reported several points of financial concern for military families including compensation and benefits, spending patterns, personal financial management skills, frequent or unpredictable deployment cycles, and access to digital or postal communications while deployed. All of these concerns can potentially lead to delays in meeting financial commitments.

The Government Accountability Office (GAO) reported several points of financial concern for military families including compensation and benefits, spending patterns, personal financial management skills, frequent or unpredictable deployment cycles, and access to digital or postal communications while deployed. All these concerns can potentially lead to delays in meeting financial commitments. Additionally, frequent change-of-station moves can make it more difficult for a member’s spouse to maintain consistent employment and earnings.

Military Readiness: Department of Defense Domain Readiness Varied from Fiscal Year 2017 through Fiscal Year 2019

Military Family Advisory Network’s (MFAN) 2023 Military Family Support Programming Survey reported 54.8% of respondents relocated in the past two years, most of them spending $500 to $1,000 out of pocket, and 43% stated that they received reimbursement in one to two months. A family accustomed to budgeting with two income streams might struggle with debt payments following a move to a duty station where the military spouse is unable to find employment or where pay levels are significantly lower for similar work.

2023 Military Family Support Programming Survey

Service members surveyed in 2022 reported experiencing 16 financial challenges.

The top five challenges by percentage of respondents included unplanned financial support to a family member (17%), relationship issues (15%), borrowing money from family or friends (13%), paying overdraft fees more than twice in the preceding year (10%), and withdrawing retirement funds to pay living expenses (10%).

2022 FINRED Status of Forces Survey

The Congressional Research Service (CRS) reported on military personnel and family concerns. The study found that spending patterns and money management skills contributed to financial challenges more significantly than pay. Core aspects of military life including unpredictable deployments, frequent moves, spouse employment challenges, housing costs, financial literacy, predatory lending, and the age of Service members (40% are 25 years old or younger) add complexity to the financial outlook for Service members and their families.

2022 Military Families and Financial Readiness Report

A 2021 MFAN survey reported barriers to saving including insufficient pay, inflation, housing costs, debt, living expenses, and a lack of understanding and implementing personal financial planning. Of the families surveyed, 51.8% had trouble saving money over the past two years and 57% had experienced a financial emergency at some time. In 2023, MFAN reported that 79.8% of respondents pay more than they can afford for housing and 22.2% currently serving members have less than $500 in savings. Other points of concern included the availability of health care and child care, and resources to support separation.

2021 Military Family Support Programming Survey

2023 Military Family Support Programming Survey

Blue Star Families’ 2024 Military Family Lifestyle Survey reported military families are challenged by pay issues (50% of active-duty members), high relocation costs (32% of members and spouses), and spouse unemployment (54% of spouses). Pay issues ranks as the top financial challenge for 46% of families, which is nearly double the amount reported a few years ago (24% in 2021). Families (70%) reported paying more than $500 out-of-pocket during moves. The survey also cited that relocation expenses may take up to 12 months or more to finically recover. Lastly, relocations create challenges for spouse employment, with job searches taking more than three months and 25% of job searches lasting more than nine months. Frequent moves and finding child care after relocating fuel this issue.

2023 Military Family Support Programming Survey

2024 Military Family Lifestyle Survey

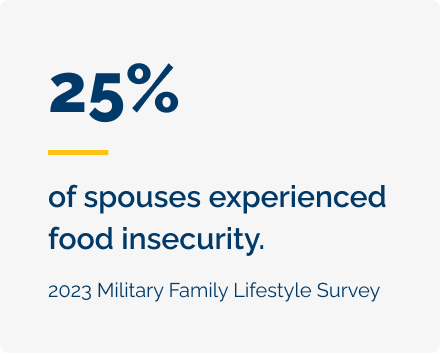

Results of the 2021 Active Duty Spouse Survey and 2023 Military Family Lifestyle Survey showed that 25% of spouses experienced food insecurity. Blue Star Families reported a lack of knowledge (54% of active-duty families) about Basic Needs Allowance (BNA) and only 3% of active-duty families applied for BNA.

Results of the 2021 Active Duty Spouse Survey and 2023 Military Family Lifestyle Survey showed that 25% of spouses experienced food insecurity. Blue Star Families reported a lack of knowledge (54% of active-duty families) about Basic Needs Allowance (BNA) and only 3% of active-duty families applied for BNA.

2021 Active Duty Spouse Survey

2023 Military Family Lifestyle Survey

A Rand Corporation study from 2023 showed that the U.S. Department of Agriculture classified approximately 15.4% of active-duty personnel and families as having low food security in 2018. It classified another 10.4% as having very low food security, with food insecurity highest among those living on post. Of those classified as food insecure in 2018, 14% reported using food assistance in the past year.

Food Insecurity Among Members of the Armed Forces and Their Dependents

The Department of Agriculture estimated that 12.8% of the general U.S. population experienced food insecurity in 2022. The 2022 data for food insecurity and very low food security were statistically significantly higher than the rates recorded in 2021 (10.2% and 3.8%).

Food Security and Nutrition Assistance

MFAN has studied food insecurity in the military population since 2017. Initially, MFAN found that 20% of military and veteran families were food insecure; In 2021, MFAN reported that number was 16.7%. Even more alarming is that MFAN reported that 27.7% currently serving families experienced some level of food insecurity, an increase from 23.3% from 2021. Moreover, 18.8% of families who joined the military in the last 10 years scored very low on food insecurity.

2023 Military Family Support Programming Survey

Blue Star Families’ Survey reported that one out of six active-duty families experienced food insecurity and one in four enlisted families. More specifically, 27% of enlisted active-duty members reported low or very low food insecurity.

2023 Military Family Lifestyle Survey

In 2022, the U.S. Department of Agriculture reported 53.5% of WIC eligible families sought assistance, a statistically significant increase from 2021. WIC is a government program to safeguard the health of low-income women, infants, and children who are at nutrition risk.

National and State-Level Estimates of WIC Eligibility and Program Reach in 2022

According to the 2022 FINRED Status of Forces Survey, the financial well-being scores of Service members outpaced their civilian peers. In 2022, Service members demonstrated positive financial behaviors in several areas and exhibited higher financial literacy knowledge, indicating they are better equipped to face financial challenges.

In comparison to the Federal Reserve’s 2022 Survey of Household Economics and Decision Making (SHED), the DOD showed that in 2020, 24% of active duty and 21% of reserve component members scored 50 or below (on a scale of 100), compared to 38% of non-military adults. In 2022, the number of Service members scoring below this threshold increased (39% of active duty and 33% of reserve component). In general, the financial well-being of military Service members declined as did their civilian counterparts across several measurements. The DOD noted that declines in holistic financial well-being since 2020 are consistent with non-military families.

2022 FINRED Status of Forces Survey

The 2018 National Association of Realtors® Veterans & Active Military Home Buyers Profile compared active duty and veteran home buyers and sellers with those who have never served. The findings showed that 56% of active duty and 41% of veterans are 100% financed compared to 7% non-military.

Home of the Brave

The Consumer Financial Protection Bureau (CFPB) compared younger Service members and civilians in 2020. The CFPB found that Service members are:

• more likely to have an auto loan or a credit card

• slightly more likely to have a mortgage

• and less likely to have a student loan or a third-party collection account

Also, Service members who served at least five years had the healthiest credit records by age 24. Those who served less than five years experienced a drop in credit score of about 20 points after separation. Those who joined the military before age 20 and left in less than five years had a subprime score at age 24. In many cases, credit scores dropped due to delinquencies and defaults following military service.

Financially Fit? Comparing the Credit Records of Young Servicemembers and Civilians

Service members are three times more likely than civilians to take out payday loans.

Why Financial Literacy Matters After Returning Home from War: Reducing Veteran Homelessness by Improving Money Management

Predatory lenders target military populations, seeking out young and financially inexperienced Service members with savings accounts and steady income.

Report on Predatory Lending Practices Directed at Members of the Armed Forces and Their Dependents

In 2020, the CFPB received over 40,800 complaints from Service members, an increase of 14% from the previous year. Most of these complaints were related to credit or consumer reporting, debt collection, and mortgages. Service members submit complaints about debt collection practices at a higher rate than civilians.

Financially Fit? Comparing the Credit Records of Young Servicemembers and Civilians

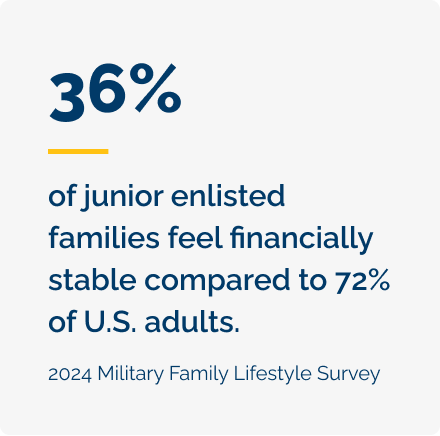

The Military Family Research Institute (MRFI) at Purdue University released its “Measuring Communities Spotlight Report” in September 2024. The report noted that pay and compensation for military families lags behind non-military households by nearly $14,000. MRFI cited Blue Star Families’ 2023 survey, stating that 40% of active-duty families’ and one-third of Guard and reserve households’ top concern is pay.

2024 The Financial Well-Being of Military and Veteran Families in the United States

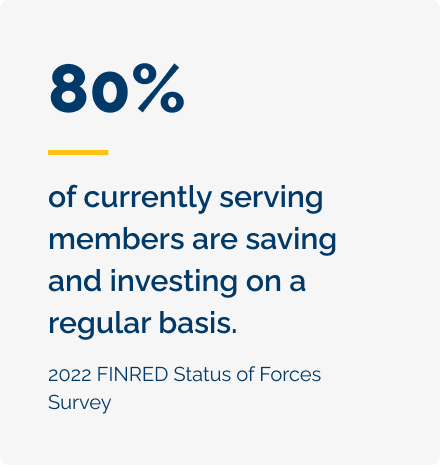

The 2022 FINRED Status of Forces Survey (SOFS) reported that 35% of active-duty and reserve component military families have less than three months’ worth of emergency savings. Junior enlisted personnel were more likely to have no emergency savings despite stating the importance of saving for an emergency. In 2019, 17% of active duty and reserve Service members indicated they had no emergency savings. The current edition of the SOFS reported 88% of active-duty members and 86% of reservists had an emergency savings account. However, MFAN reported that 25% of the 2023 respondents had less than $500 in emergency savings.

The 2022 FINRED Status of Forces Survey (SOFS) reported that 35% of active-duty and reserve component military families have less than three months’ worth of emergency savings. Junior enlisted personnel were more likely to have no emergency savings despite stating the importance of saving for an emergency. In 2019, 17% of active duty and reserve Service members indicated they had no emergency savings. The current edition of the SOFS reported 88% of active-duty members and 86% of reservists had an emergency savings account. However, MFAN reported that 25% of the 2023 respondents had less than $500 in emergency savings.

2022 FINRED Status of Forces Survey

2023 Military Family Support Programming Survey

2024 Military Family Lifestyle Survey

Sixty-nine percent of food-insecure military families reported they had an emergency savings account and most reported having only enough money to cover expenses for three months or less. About 30% of food-insecure families had less than a month’s expenses to cover a financial emergency, and fewer than 10% of food-insecure families had enough savings to cover three to six months of expenses. Specifically, Permanent Change of Station (PCS) moves impact Service members, leaving them unable to deal with an emergency.

Food Insecurity Among Members of the Armed Forces and Their Dependents

The majority of active-duty families (72%) described their financial situation as “doing okay” or “living comfortably,” according to a Blue Star Families 2023 survey.

2023 Military Family Lifestyle Survey

Spouses manage finances in most military families. Spouses experience more stability and awareness of the day-to-day expenses compared to Service members, who are subject to frequent deployments and temporary assignments.

Spouses Play a Critical Role in Military Family Finance

The U.S. Securities and Exchange Commission wrote that spouses are responsible for the family’s financial readiness and serve as the “family’s chief financial officer.”

Military Spouses: Ensuring Financial Readiness on the Homefront

In 2023, the Military Family Advisory Network reported that the responsibilities for financial management decisions (44.9%), budgeting (50.1%), and day-to-day finances (55.1%) often fall to the spouse as opposed to the active duty Service member. These percentages decreased since 2021.

MFAN also shared 79.8% of respondents are paying more than they can comfortably afford for housing and 82.4% currently serving families experienced this burden.

2023 Military Family Support Programming Survey

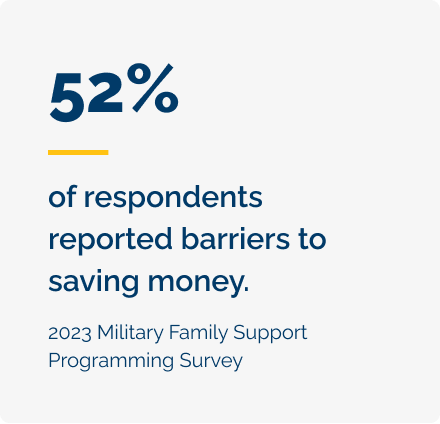

MFAN reported that job security and corresponding financial stability, along with retirement benefits, were high points of military service; however, 51.8% of respondents reported numerous barriers to saving and a limited understanding of financial planning.

MFAN reported that job security and corresponding financial stability, along with retirement benefits, were high points of military service; however, 51.8% of respondents reported numerous barriers to saving and a limited understanding of financial planning.

2023 Military Family Support Programming Survey

In February 2025, the Federal Retirement Thrift Investment Board (FRTIB), the entity that manages the Thrift Saving Plan, reported that 1.5 million BRS participants had an average balance of $17,277; and that 1.25 million Legacy Retirement Plan participants averaged $53,893 per account. 89.1% of active-duty BRS participants receive the full 5% contribution match, as do 84.4% of reservists.

Thrift Savings Plan Participant Activity Report February 2025

In comparison, the U.S. Census Bureau reported the median value of 401(k)-style accounts was $30,000 in 2020 and of working-age people in the U.S., 18.2% owned an individual retirement account (IRA), 34.6% owned a defined contribution (DC) account (401(k)/TSP), and 13.5% had a defined benefit (DB) plan (pension). Results also showed that 81.1% of people actively made contributions to their IRAs, 92.1% to their DC account, and 57.7% to their DB plan.

New Data Reveal Inequality in Retirement Account Ownership

In 2023, The U.S. Bureau of Labor Statistics (BLS) reported that 63% of civilian employees had access to a defined contribution (DC) plan, like a 401(k), and 24% had access to a defined benefit (DB) plan. In contrast, all Service members have access to a DC plan (TSP) and DB (pension) if they serve long enough.

Employee Benefits Survey Latest Numbers

The DOD’s Transition Assistance Program (TAP) is a mandatory course to help Service members transition from active duty. The Government Accounting Office reported 90% of transitioning Service members attended, but 25% of those identified as needing the maximum transition support did not. Ideally, TAP is attended more than a year from transition, but 70% of participants attended within a year of leaving the service.

Servicemembers Transitioning to Civilian Life

In 2023 MFRI reported that after separating or retirement, Service members are often underemployed. Veterans entering the civilian workforce do not always secure positions that truly reflect their skills and experiences, thus leading to underemployment. To this point, MRFI (2024) added that younger veterans (ages 18 to 24), roughly 60% of veterans, are more likely to by unemployed.

Measuring Our Communities: The State of Military and Veteran Families in the United States

2024 The Financial Well-Being of Military and Veteran Families in the United States

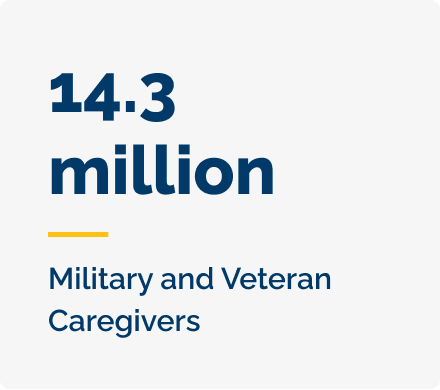

There are 14.3 million military and veteran caregivers in the United States.

There are 14.3 million military and veteran caregivers in the United States.

The 2024 report by the RAND Corporation in partnership with The Elizabeth Dole Foundation, America’s Military and Veteran Caregivers: Hidden Heroes Emerging from the Shadows, identifies the complex challenges on physical and mental health, economic mobility, and family well-being experienced by this community while providing actionable recommendations for support.

Key Findings include:

- The economic value provided by military and veteran caregivers, activities which are largely uncompensated, ranges from $119 billion to $485 billion per year.

- Caregivers incur an estimated $8,583 in annual out-of-pocket expenses associated with caregiving and forgo about $4,522 in annual household income.

- 74% of military and veteran caregivers are caring for individuals over age 60.

- Over half of military and veteran caregivers to individuals 60 and under were nontraditional caregivers including friends, neighbors, and relatives.

- 42% of military and veteran caregivers to those 60 and under met criteria for depression, almost four times the rate of non-caregivers.

Learn more about this diverse and resilient community at America’s Military and Veteran Caregivers: Hidden Heroes Emerging from the Shadows.

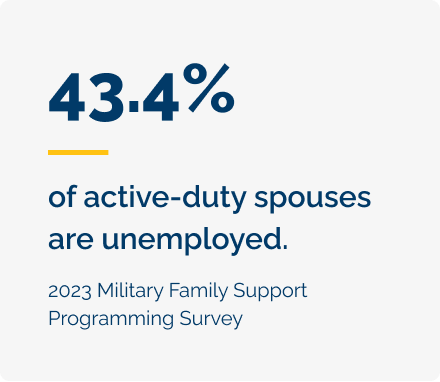

According to the 2021 Office of People Analytics Active Duty Spouse Survey, 64% of spouses were in the civilian workforce, and their unemployment rate is 21%. In 2023, MFAN reported 39% of active-duty spouses were employed full time and 18% part time.

According to the 2021 Office of People Analytics Active Duty Spouse Survey, 64% of spouses were in the civilian workforce, and their unemployment rate is 21%. In 2023, MFAN reported 39% of active-duty spouses were employed full time and 18% part time.

The primary reason that many spouses are not employed outside the home is because they are working in the home providing child care. Frequent PCS moves, living on base, and geographic separation due to temporary duty are also key contributors to spouse unemployment and underemployment, when the spouse accepts a job below their level of experience, skills, and training. The average time that unemployed spouses looked for work was 19 weeks.

2021 Active Duty Spouse Survey

2023 Military Family Support Programming Survey

Frequent PCS moves make it more difficult for a spouse to maintain consistent employment and earnings. A family accustomed to budgeting with two income streams might struggle financially following a move when the military spouse is unable to find employment or where pay levels are significantly lower for similar work.

Military Readiness: Department of Defense Domain Readiness Varied from Fiscal Year 2017 through Fiscal Year 2019

2022 Military Families and Financial Readiness Report

Military spouse employment is a challenge. Purdue University’s Military Family Research Institute reported that more than 47% of spouses require at least four months to find a job; coupled with frequent moves, this time adds up. The lack of employment and subsequent loss of income impacts financial well-being in the near term; however, over the long term, it can affect the family’s ability to retire. For instance, 58% of spouses reported they fail to meet the vesting requirements of employer-sponsored plans, reducing their retirement nest egg.

Measuring Our Communities: The State of Military and Veteran Families in the United States

Money management problems, which are often tied to a lack of financial education or discipline, leading to a significantly higher likelihood of homelessness, are more likely for those making above $50k. Veterans with financial issues or problematic financial status reported greater difficulty adjusting to civilian life and negative impacts on their overall well-being.

Money management problems, which are often tied to a lack of financial education or discipline, leading to a significantly higher likelihood of homelessness, are more likely for those making above $50k. Veterans with financial issues or problematic financial status reported greater difficulty adjusting to civilian life and negative impacts on their overall well-being.

Financial Status and Well-being in Recently Separated Military Veterans

Why Financial Literacy Matters After Returning Home from War: Reducing Veteran Homelessness by Improving Money Management

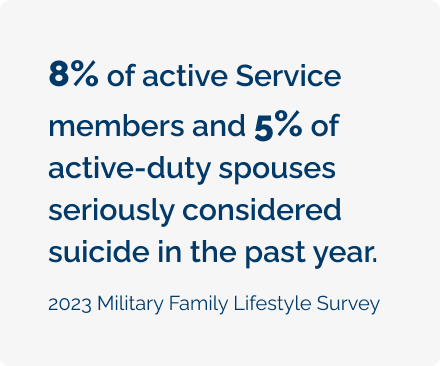

Of active Service members and veterans surveyed, 81% of respondents indicated that their finances caused them at least some stress over the past 12 months and financial pressure has been detrimental to their emotional and mental health.

2023 Military Family Support Programming Survey

Financial problems increase the odds of suicidal ideation and suicide attempts in veterans. Of the seven types of social stress factors: violence, housing instability, financial-employment problems, legal problems, family problems, lack of access to care-transportation, and psychosocial needs, researchers found that 16.4% of patients had a least one social stress indicator and that each additional stressor increased odds of suicidal ideation by 67%. Four of the top 20 suicide risk factors are finance-related, and 23% of veterans reported having financial problems before a suicide attempt.

Recent Stressful Experiences and Suicide Risk: Implications for Suicide Prevention and Intervention in U.S. Army Soldiers

Social Determinants and Military Veterans’ Suicide Ideation and Attempt: A Cross-sectional Analysis of Electronic Health Record Data

Service members are three times more likely than civilians to take out payday loans.

Why Financial Literacy Matters After Returning Home from War: Reducing Veteran Homelessness by Improving Money Management

MFAN shared 79.8% of respondents are paying more than they can comfortably afford for housing and 82.4% currently serving families experienced this burden.

2023 Military Family Support Programming Survey

Research

Learn more about military family demographics and financial well-being from industry reports.

Know another report that should be here? Let us know.