How Credit Card Interest Is Calculated

The old saying, “There’s no such thing as a free lunch,” applies to credit card debt.

Credit Comes With Strings Attached

Most credit cards come with some strings attached, such as the potential for interest charges and fees. These strings can make a big impact on how much you pay for using your card. The most common expense attached to a credit card is the interest rate charge.

Credit Card Interest

Credit card interest works by charging you for the amount of money you borrow when you make a purchase with your card. If you don’t pay off your balance in full by the due date, you will be charged interest on the remaining balance.

The rate charged on your card is usually expressed as an Annual Percentage Rate (APR) and will vary depending on a number of factors, such as your credit score, the type of card you have, and your overall credit reputation. Credit card APRs are generally variable and can even vary depending on the type of charge. For example, there may be one rate for purchases and another for cash advances.

The main thing to remember with credit card interest rates, is the higher the rate, the more you pay on balances you do not pay in full by the due date.

How Interest is Calculated

Every day counts when you carry a balance on your credit card past the due date. Interest charges are calculated daily, which is why it is so important to strive to pay off your balance in full each month or keep the balance as low as possible.

Let’s dig into the details on exactly how interest is calculated.

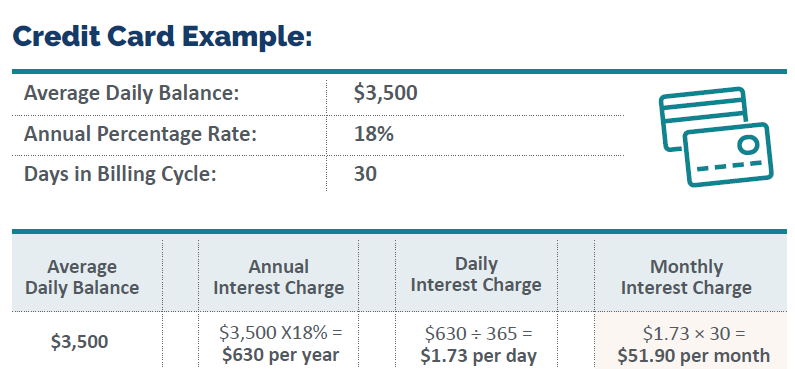

Step 1. The Average Daily Balance

First, the Average Daily Balance is determined by adding up the account balances for each day in the billing cycle and dividing by the number of days in the cycle. The number of days in the billing cycle may vary slightly month-to-month.

Step 2. The Annual Interest Charge

Next, the Annual Interest Charge is calculated by multiplying the Average Daily Balance by the APR.

Step 3. The Daily Interest Charge

Then, the Daily Interest Charge is calculated by dividing the Annual Interest Charge by 365 days.

Step 4. The Monthly Interest Charge

Finally, calculate the Monthly Interest Charge by multiplying the daily interest charge by the number of Days in the Billing Cycle.

A Real-Life Example

Joe carries an average daily balance of $3,500 on his credit card. His APR is 18%. Here is the interest he will be charged on a 30-day billing cycle:

Tip from Katie Casey-Macias, CFP®

A credit card in your wallet is not a license to spend. Never take on debt without a plan to pay it back.