Leaving Assets to Loved Ones

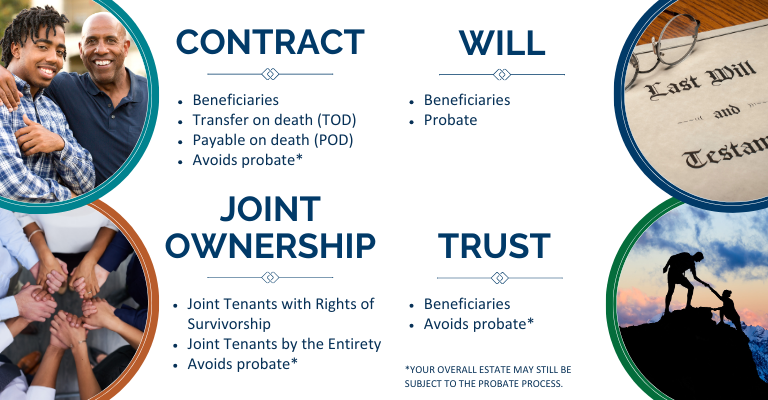

Planning the distribution of your assets after your passing is a critical part of any estate plan. There are several methods to transfer your assets to loved ones, each offering different benefits and considerations. The chart below explores four key options to consider when crafting your plan.

Contract

Transferring assets by contract involves designating beneficiaries through legal agreements, such as life insurance policies, retirement accounts, or payable (transfer) on death bank and investment accounts. This ensures the assets pass directly to the named individuals without going through probate.

Examples of transferring assets by contract would be naming a loved one as the beneficiary on a life insurance policy or retirement account.

Will

Transferring assets by will involves specifying in a legal document how your property and assets should be distributed upon your death. The process of transferring assets by will is typically overseen by probate to ensure the will’s validity and proper execution.

An example of transferring an asset through a will, would be leaving your classic car to your nephew by documenting this wish in your will.

Joint Ownership

Transferring assets through joint ownership allows the surviving co-owner to automatically inherit property without the need for probate. The jointly owned property would pass directly to them upon your death.

An example of transferring an asset through joint ownership, would be an elderly parent adding their adult child as a joint owner to their checking account

Trust

Transferring assets through a trust involves placing your assets into a trust, managed by a trustee, who then distributes the assets to your beneficiaries according to the terms you set. Transferring assets through a trust bypasses the probate process for those assets.

An example of transferring an asset through a trust, would involve placing a savings account into the trust, ensuring the money is distributed to your beneficiaries according to your instructions.