The Biggest Question Facing Many Military Retirees in 2026

Posted in Category: Retirement

Tagged with : Retirement

Would you trade part of your lifetime pension for a six-figure check today?

For the first time in military retirement history, a generation of Service members is being asked to answer this financial decision when they retire.

Back in 2018, thousands of Service members opted into the newly launched Blended Retirement System (BRS). Starting this year, many of those same Service members are becoming the first true wave of BRS retirees — and they are facing an important question:

Do you take full monthly retirement pay for life, or accept a reduced pension in exchange for a lump sum today?

At first glance, this may feel similar to a lottery payout decision – more money now or more guaranteed income over time. While the rules are different, one thing is the same: once that decision is made, it’s permanent.

What Is the BRS Lump Sum?

Under BRS, eligible retirees with at least 20 qualifying years of service may elect a one-time lump-sum payment equal to a discounted portion of the present value of their future retired pay.

That’s a mouthful, but here’s what it really means.

You can choose to receive some of your retirement payment early as a lump sum today. In exchange, your monthly retired pay is temporarily reduced until you reach age 67, when it returns to your full, unreduced monthly pension amount.

Your options include:

- No Lump Sum: Full monthly retired pay for life

- 25% Lump Sum: Lump sum plus 25% reduced monthly retired pay until 67

- 50% Lump Sum: Larger lump sum plus 50% reduced monthly retired pay until 67

The lump sum payment is taxable, so keep that in mind.

Reasons Why Some Retirees Choose the Lump Sum

Some retirees may value having access to a large amount of money early in retirement to:

- Pay off high-interest debt

- Purchase a home

- Launch a business

Others plan to invest the lump sum and believe long-term returns could offset reduced payments.

Be careful about this approach.

First, the lump sum is taxable, which reduces the amount you can actually invest. Second, the lump sum payment is discounted by nearly 6.5%. In simple terms, your investments would need to consistently outperform that discount rate plus taxes to break even.

Health concerns, family history, and legacy planning also influence this decision, since the lump sum becomes a personal asset that can be invested, gifted, or passed on.

Reasons Why Some Retirees Don’t Choose the Lump Sum

Military retired pay is rare and extremely valuable since it’s government-backed and adjusted for inflation. Retirees who expect a long retirement may receive significantly more income by preserving their full monthly retired pay.

How much more?

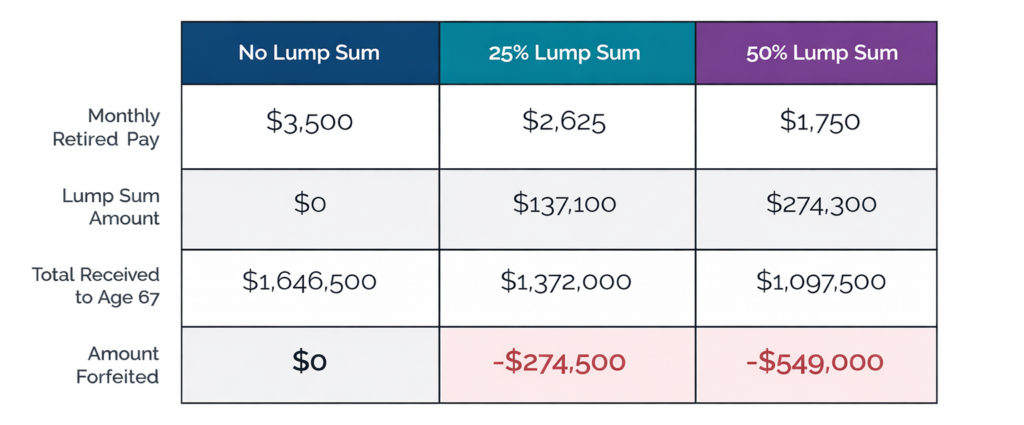

Let’s assume a Service member retires at age 40 after 20 qualifying years with a monthly pension of $3,500. Between ages 40 and 67, they would collect approximately $1.6 million in total retired pay (adjusted for cost of living).

Choosing a lump sum changes that picture:

- A 25% lump sum may provide approximately $137,100 upfront, which would be taxable, but the impact of reduced monthly payments would lower total income received by $274,500 through age 67.

- A 50% lump sum could reduce total retired pay by more than $500,000 over the same period.

After age 67, the reduced pension options return to the full pension amount.

Finally, Reservists, who typically begin retired pay later in life, may not experience reductions of this magnitude since fewer payments are reduced before full retired pay resumes at age 67.

The Most Important Question

The real question isn’t which option is “better.” Rather, the most important question to ask is, “What is the best choice for my financial plan, my family, and my comfort with risk?

Two retirees can make different choices — and both can be right.

Before deciding, use the USAA Educational Foundation® BRS Lump-Sum Calculator to model your lump sum and reduced monthly pay.

The USAA Educational Foundation is a nonprofit, tax-exempt IRS 501(c)(3) and cannot endorse or promote any commercial supplier, product, or service. The content of this blog is intended for information purposes only and does not constitute legal, tax, or financial advice.