Are You Ready for Tax Bracket Madness?

Basketball and Taxes

Here’s a random thought, unless you’re a pro basketball player, you’ll probably never think of basketball and taxes together. But in a strange way, the two worlds collide in March for hoops fans and tax filers alike.

Basketball, because of March Madness buzzer beaters and bracket busters. Taxes, because of filing deadlines and federal income tax brackets.

And whether you’re a basketball fan or not, understanding tax brackets is a game we all need to play. To illustrate how this game works, imagine your taxable income as a team playing in the ultimate tax tournament. Let’s start with reviewing the federal income brackets for 2024 tax returns and play through two different scenarios.

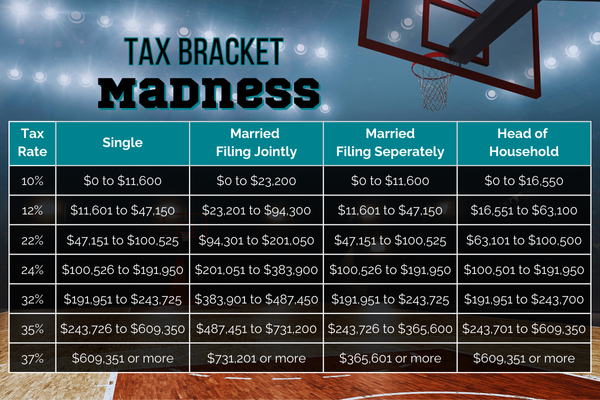

Federal Income Tax Brackets for 2024 Tax Returns

Love and Basketball

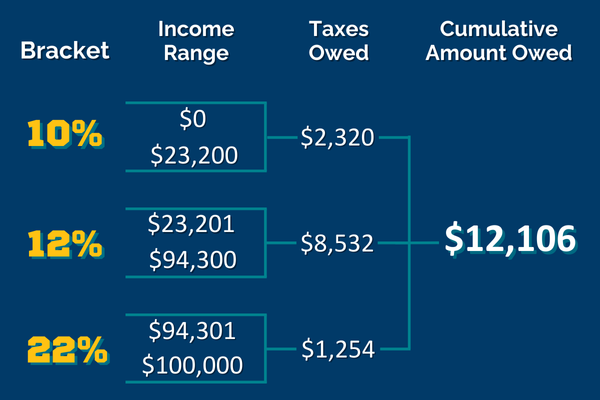

Suppose newlyweds Quincy and Monica have taxable income of $100,000 this year and file their taxes jointly. According to the chart shown above, it might feel like a slam dunk to assume they are taxed 22% on the full amount and will face a tax liability of $22,000. However, this game is played with a little more nuance.

Here is how the $100,000 is taxed as this couple advances through several tax brackets.

- 10% Bracket: The first $23,200 they earn is taxed at 10%, and results in $2,320 of taxes due from this bracket.

- 12% Bracket: The dollars earned from $23,201 to $94,300, face a 12% tax, adding up to $8,532 due from this bracket.

- 22% Bracket: The dollars they earn over $94,301 triggers a 22% tax and results in a total liability of $1,254 for this bracket.

So, let’s tally the results for these newlyweds. Quincy and Monica advance through three tax brackets, spreading their dollars around the court, and incur a tax liability of $12,106 or 12.1%.

This amount is significantly less than the 22% we originally assumed.

Single and Ballin’ Out

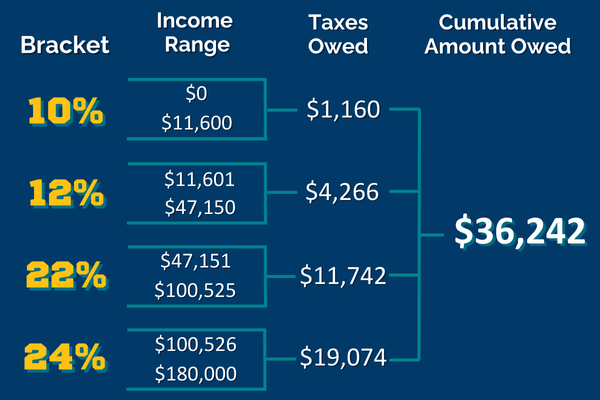

Suppose Duke is single and “ballin’” in more ways than basketball. His taxable income is $180,000 this year, landing him firmly in the 24% bracket. But as with the previous example, things are not as obvious as they might seem.

Here is how the $180,00 is taxed as Duke advances through several tax brackets.

- 10% Bracket: The initial $11,600 is taxed at 10%, for a total of $1,160 in this bracket.

- 12% Bracket: From $11,601 to $47,150 his team faces a 12% tax, adding up to $4,266 for this bracket.

- 22% Bracket: Advancing to the next bracket, means the dollars earned from $47,151 to $100,525 will trigger a 22% tax, adding up to $11,742 for this bracket.

- 24% Bracket: The final dollars earned above $100,526 are taxed at 24%, adding up to $19,074 owed from this bracket.

For those scoring at home, Duke advances through four tax brackets and incurs a potential tax liability of $36,242 or approximately 20.1% of taxable income.

This amount is less than the 24% we originally assumed.

Cut Down the Nets

While I only shared examples for single and married (filing jointly) taxpayers, the logic and approach work the same for Married Filing Separately and Head of Household. The numbers are just different.

It’s also important to understand that the information presented in this blog is not to be taken as tax advice and everyone’s situation is different. We’re just trying to help you understand how the brackets work.

If you need an assist in completing your tax return this year, MilTax offers free software and support to ensure your tax return is a winner.

The USAA Educational Foundation is a nonprofit, tax-exempt IRS 501(c)(3) and cannot endorse or promote any commercial supplier, product, or service. The content of this blog is intended for information purposes only and does not constitute legal, tax, or financial advice.