Be Prepared for Caregiving With a Smart Monthly Budget

Create a personalized monthly budget that supports your family's unique needs. It's quick, simple, and built for you.

Start Your BudgetA budget is your financial compass. If you’ve never budgeted before, or if caregiving has altered your financial situation, building a budget can help you navigate choices and challenges ahead.

Shawn Moore shares firsthand experience of how budgeting brings control to the unpredictable financial challenges of caregivers’ daily lives. She recommends finding the budgeting method that works best for you. “It doesn’t matter how you budget. It just matters that you do it.”

Your budget should focus on essential expenses and put you on the path toward achieving meaningful goals like debt reduction, emergency savings, or home ownership. A budget can help you:

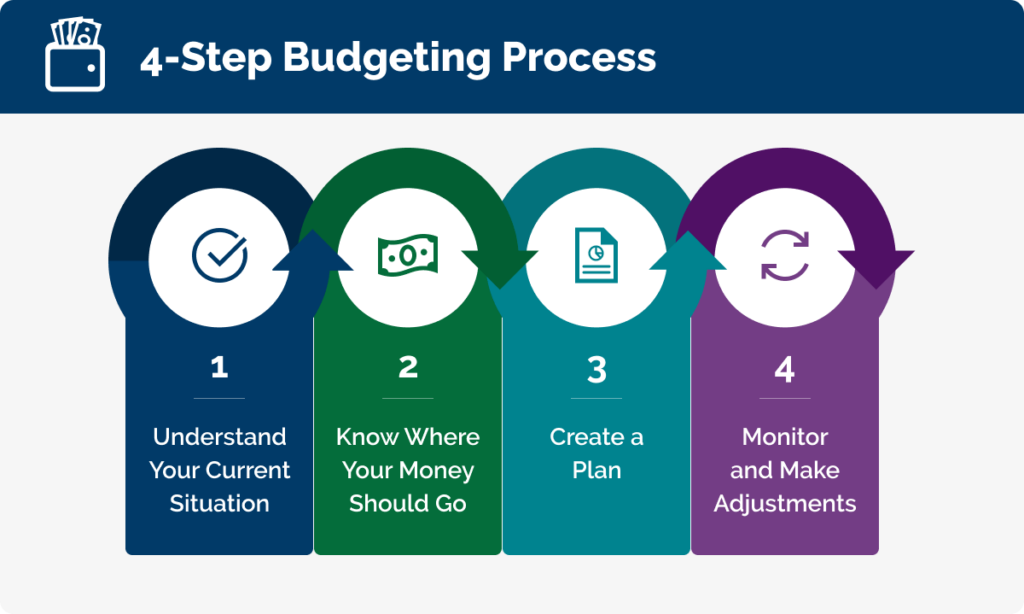

There are many budgeting methods out there, from mobile apps and spreadsheets to simply putting pencil to paper. There’s no right or wrong answer – find a method that works best for you and stick to it. A simple place to start is the Build Your Budget worksheet, which will walk you through these steps:

Know your inflows (money coming in) and outflows (expenses going out). Review your previous month’s banking or credit card statements or save and analyze receipts for the next 30 days to establish your baseline.

Consider these guidelines as you’re analyzing your money:

Build a plan that meets your current needs and any anticipated expenses like medical expenses and/or accommodations.

Budgeting is not a one and done exercise. As your situation changes, so should your budget.

Complete this worksheet to figure out how much money is coming in, how much is going out, and where you can make changes.

Complete this worksheet to figure out how much money is coming in, how much is going out, and where you can make changes.

This content was developed in proud partnership with