Credit & Debt

Learn how you can use credit and debt wisely to benefit your bottom line.

Credit and debt are two sides of the same coin: Credit enables you to borrow money for large purchases, but sometimes, the debt accumulated from borrowing can become a burden to pay back.

Understanding Credit

Oftentimes, caregivers are in charge of money matters for their household. Understanding the finer points of how credit works can help you make financial decisions that support your goals.

Credit Report Basics

Your credit report is a record of your past credit behaviors. Potential employers, landlords, and lenders may use this information to decide your financial dependability. Since your credit report is so important, you should carefully review it to ensure the information contained in the report is correct. Visit www.annualcreditreport.com to access your free, yearly credit report from each of three major reporting bureaus: Equifax, TransUnion, and Experian.

|

|

|

| equifax.com

(888) 766-0008 |

experian.com

(888) 397-3742 |

transunion.com

(800) 680-7289 |

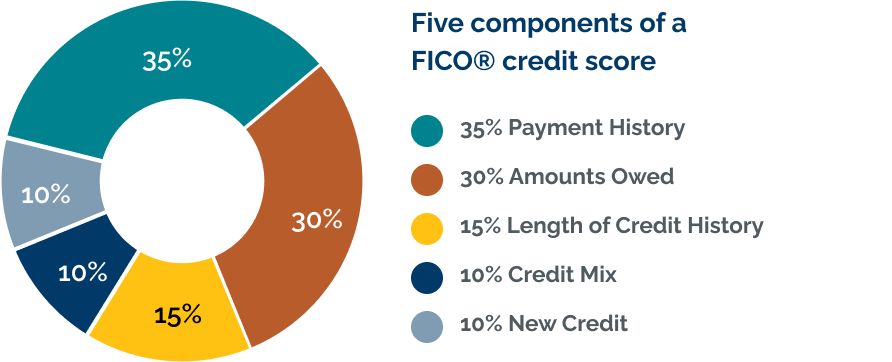

Credit Score Basics

Your credit score is like a “test grade” demonstrating your reputation as a borrower. The FICO® score is the most common and ranges from 300 to 850, with the higher scores being better. Generally, a score above 670 is considered to be good and a score below 580 may indicate problems. Your credit score can change over time, and your number today may be different in six months or a year, depending on the information in your credit report and how you manage the components that determine your score.

How to Improve Your Credit Score

- Pay your lenders on time.

- Reduce credit card balances. Either pay off your credit card bill each month or keep your balance as low as possible.

- Don’t apply for credit you don’t need.

- Keep credit and loan information secure to reduce the risk of identity theft.

- Review your monthly statements for errors.

Managing Debt

Unexpected expenses happen to everyone, and for caregivers, medical expenses can add an extra burden. Caregiving responsibilities can also limit your options for minimizing expenses or increasing income. Learn more about the different types of debt, using debt to your advantage, and taking control of what you owe.

What is Debt?

Debt is the amount you owe to creditors for goods and services that you buy now and promise to pay for later, plus the cost of interest. There are two major categories of debt: secured debt (backed by collateral like a house or car) and unsecured debt (no collateral like a credit card or student loan). Generally, unsecured debt carries a higher interest rate because it is riskier to lenders.

Sometimes, a major life change like becoming a caregiver can lead to an increase in the amount of debt you carry. While it is not unusual to experience an increase in debt due to sudden changes in expenses, income, or lifestyle, it is critical to understand how your financial life has changed and adjust accordingly.

Assessing and Addressing Debt

Swipe through a few key actions you can take to understand your financial context and take control of the future.

Tip from Katie, CFP®

You have many responsibilities as a caregiver, including being a household CFO. Don’t be afraid to ask for help when needed. If you find you’re having trouble making payments on your debts, contact your lenders and share your situation. You may be eligible for changes in your repayment plan or other assistance.

Paying Back Student Loans

The prospect of paying back your student loans may seem scary, but remember you are not alone. According to recent studies, approximately 45 million Americans hold student loans, and nearly half of those borrowers owe more than $20,000.

Fortunately, there are several student loan repayment strategies available to pay back the money you borrowed. To determine the right student loan repayment strategy, it’s important to know if you have private or federal loans.

- Repayment options are set by the lender.

- Typically offer in-school and deferred repayment options.

- In most cases, you can refinance and consolidate your private student loans to extend your loan term and possibly qualify for a lower interest rate.

- Communicate with your lender if you’re having trouble making payments. Be ready to explain what you can afford to pay and have a detailed budget available to help make your case for lower payments.

- Private student loan lenders are not required to offer you any relief, but a responsible lender will want to work with you to help you stay out of default.

- A lender might allow a forbearance or temporary postponement of payments to help you avoid delinquency and default.

- There are several repayment plans available for federal student loan debt. Work with your loan service provider to choose a plan that is affordable for you.

- Loan terms can go up to 30 years and payment plans may be standard, graduated, extended, or income-driven.

- You can change your loan repayment plan at any time to suit your current needs.

- If you have experienced a reduction in earnings, an income-driven repayment plan, like the SAVE Plan, may help lower your monthly payments.

- You may be eligible for loan forgiveness under the Public Service Loan Forgiveness (PSLF) Program if you’re employed by a government or nonprofit organization. Learn more to see if you qualify.

- Communicate with your loan servicer if you’re having trouble making payments. Be ready to explain what you can afford to pay and have a detailed budget available to help make your case for lower payments.

- Visit studentaid.gov for more information.

This content was developed in proud partnership with