How to Prepare for Tax Season

Posted in Category: Taxes

Tagged with : Personal Finance Tips, Taxes

Ready or not, here it comes! Tax season is right around the corner and many of us are already dreading the stress of gathering documents, understanding credits and deductions, and ensuring everything is filed correctly. But with proper preparation, you can save time, reduce anxiety, and even help maximize your tax refund.

Here are six tips to get ready:

1. Organize Your Documents Early

Start by gathering all necessary paperwork. This includes W-2s, 1099 forms, receipts, bank statements, and any other relevant documents related to income, deductions, or credits. Sorting them into those categories can make the process smoother when you’re ready to file. The IRS outlines the documents you’ll need to get started.

2. Review Last Year’s Tax Return and Track Any Life Changes

One thing you can count on in the military is change. Life events such as PCS, deployment, new job, getting married/divorced, having a child, and buying a home can affect your tax situation. Looking at your previous year’s return can provide a helpful reference. Take note of deductions or credits you might qualify for again. Then, note any new milestones this year that might impact your tax situation.

3. Know Your Benefits

Members of the military may qualify for military family tax benefits available through the IRS. In addition, the Military Spouse Residency Relief Act (MSRRA) provides options for claiming state of legal residence. Military Spouses have three options:

• Keep their own state of legal residence.

• Use their service member’s state of legal residence.

• Use their Permanent Change of Station (PCS) state.

Understanding the benefits and tax breaks for service members and dependents will help you prepare and apply to your current tax situation.

4. Consider Working with a Professional

The great news is you don’t have to face tax season by yourself. Tax professionals can help you navigate deductions, credits, and any other nuances that might apply to your specific situation, ensuring you don’t miss out on savings. Military OneSource offers free software and support from military tax experts through MilTax.

5. Contribute to Retirement Accounts

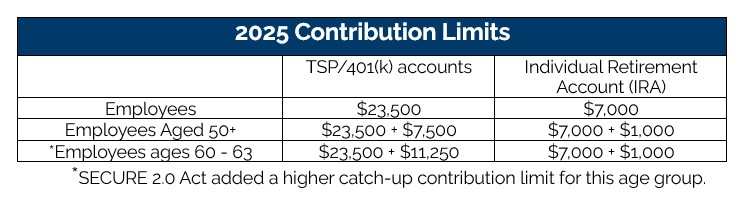

Contributions to retirement accounts, like TSPs, 401(k)s and IRAs, can potentially lower your taxable income or qualify for a tax credit. For IRA contributions, you have until the tax filing deadline (April 15, 2026) to contribute to last year’s IRA. Employer provided accounts like TSP and 401(k) are based on the calendar year. But contribution limits may change each year so be sure to check out the new limits and adjust your contributions early in the year to maximize savings.

6. File Early

The earlier you file, the sooner you can get your refund or avoid the stress of last-minute filing. Plus, filing early can reduce the risk of identity theft, as the IRS does not accept a second return filed under the same Social Security Number. Learn what tax identity theft is, how to protect yourself from it and what to do if it happens to you from the Federal Trade Commission.

The tax deadline of April 15th will be here before you know it. Embrace the challenge and get prepared. If you receive a refund when you file, this quick assessment can help you determine how best to leverage those funds to fuel your financial freedom.